What is breakdown & recovery insurance?

Do you handle vehicle recovery as part of your motor trade business? If so, buying the right kind of insurance is crucial.

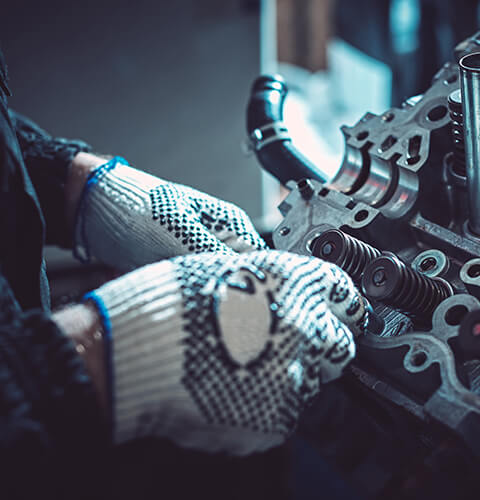

Recovery agents insurance is specifically designed to cover those who recover or repair vehicles after road accidents and breakdowns. This could be whether you manage a single recovery vehicle or an entire fleet.

If you employ staff, you’ll also want to consider taking out employer’s liability insurance and public liability insurance. This will cover your business if there is any damage to people or their properties as you operate your service.

Here at ChoiceQuote, we offer market-leading prices and transparent insurance advice. Call us today and our experts will help you select the right insurance policy for your breakdown and recovery business.

What cover do I need as a recovery agent?

The level of cover you need will always depend on the kind of business you run. There are, however, some basic features that most recovery agents will typically need, including:

- Public liability insurance

- Road risk only insurance

- Cover for damage to buildings and contents

- Cover for theft of your vehicle

- Cover for damage or theft of tools and equipment

- Customer vehicle protection

Why do I need breakdown agents insurance?

Whether you run your own recovery business or operate as a sub-contractor, covering yourself against unforeseen incidents is vital. Having recovery agents insurance ensures your motor trade business can continue functioning if hit financially from the result of an accident.

ChoiceQuote has been helping motor traders find the best deals since 1995. We’re now one of the best-known names in motor trade insurance, with a history of providing exclusive premiums to UK businesses.

Speak to an expert

To find out what options your business has, feel free to speak to one of our experts. We will go the extra mile to help you secure the exact cover you need.

No matter how unique your motor trade agency is, we are committed to helping you arrange a recovery agent insurance policy that suits your requirements. We do this by offering great value quotes and bespoke motor trade policies.

Frequently Asked Questions

Can I use motor trade insurance as a personal policy?

Motor trade insurance cover is designed for people who work in the trade and need to drive customers' cars, e.g. for road testing or recovery purposes. It should not be used as a personal 'any car' insurance policy. If you need insurance to drive any car but you are not in the motor trade, we may still be able to find you the best cover.Road risk vs combined motor trade insurance – what’s the difference?

Road risks insurance is the minimum legal requirement for motor traders and is suited to smaller traders, mostly operating from home. This could protect you against losses arising from incidents on the public roads, such as collisions with other vehicles. Motor trade combined insurance protects you against road risks and includes cover for your business premises (rented or owned), damage to bodywork or theft of a vehicle, and theft of tools or money from your property.Can I get motor trade insurance for under 25s?

If you're new to the motor trade or to driving in general, insurance premiums may be higher to reflect your lack of experience. However, we may still be able to help you in particular trades, especially in service and repair.You can save money by working for somebody else in the trade first, building up experience, before striking out on your own.Speak to us to find out more about motor trade insurance for young traders.